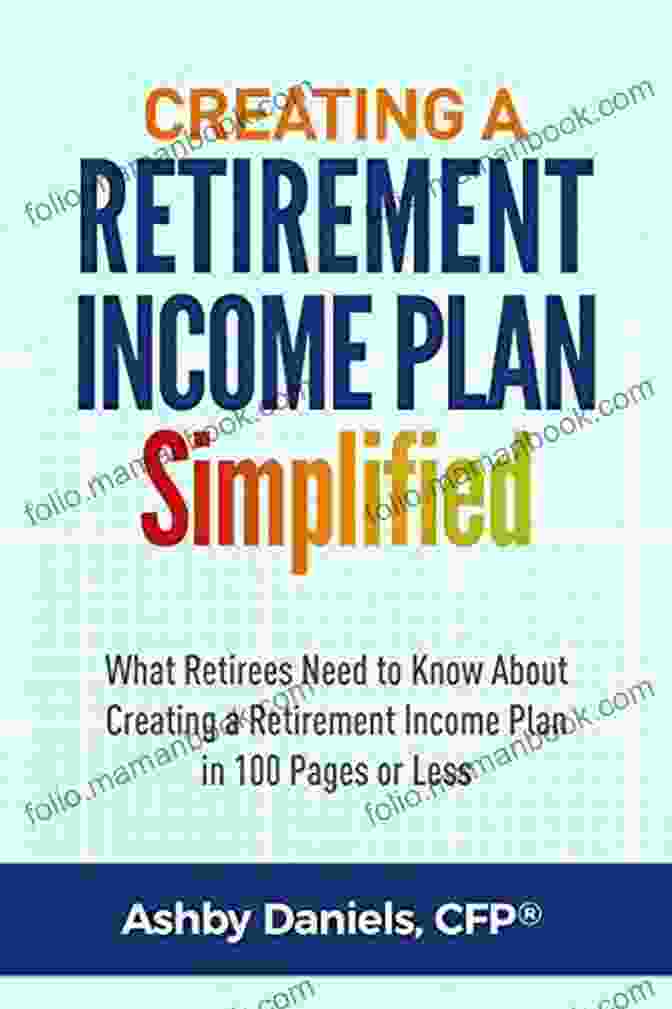

Creating a Retirement Income Plan Simplified: A Comprehensive Guide to Ensuring Financial Security in Your Golden Years

Retirement is an inevitable stage of life that requires careful planning and preparation. Creating a retirement income plan is crucial to ensure financial stability during your golden years. This article serves as a comprehensive guide to simplify the process of planning for retirement, providing actionable steps and expert insights to help you secure your financial future.

Step 1: Assess Your Financial Situation

4.7 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 93 pages |

| Lending | : | Enabled |

Begin by evaluating your current financial situation, including income, expenses, assets, and liabilities. This will provide a clear understanding of your financial starting point and help you identify areas for adjustment or improvement.

* Track your income: Determine your total income from all sources, including employment, investments, and pensions. * Identify expenses: Categorize your expenses, both fixed (e.g., mortgage, utilities) and variable (e.g., groceries, entertainment). * Review assets: List all your assets, including cash, savings, investments, and real estate. * Assess liabilities: Identify any outstanding debts, such as mortgages, student loans, and credit card balances.

Step 2: Estimate Retirement Expenses

Next, estimate your anticipated expenses during retirement. Consider both essential costs (e.g., housing, healthcare) and discretionary expenses (e.g., travel, hobbies).

* Consider inflation: Factor in the impact of inflation on your future expenses by adjusting your estimates for expected inflation rates. * Lifestyle adjustments: Anticipate changes in your lifestyle during retirement, such as reduced housing expenses or increased travel costs. * Healthcare costs: Healthcare costs tend to increase during retirement. Research and estimate potential future medical expenses. * Other expenses: Include other expected expenses, such as transportation, entertainment, and charitable donations.

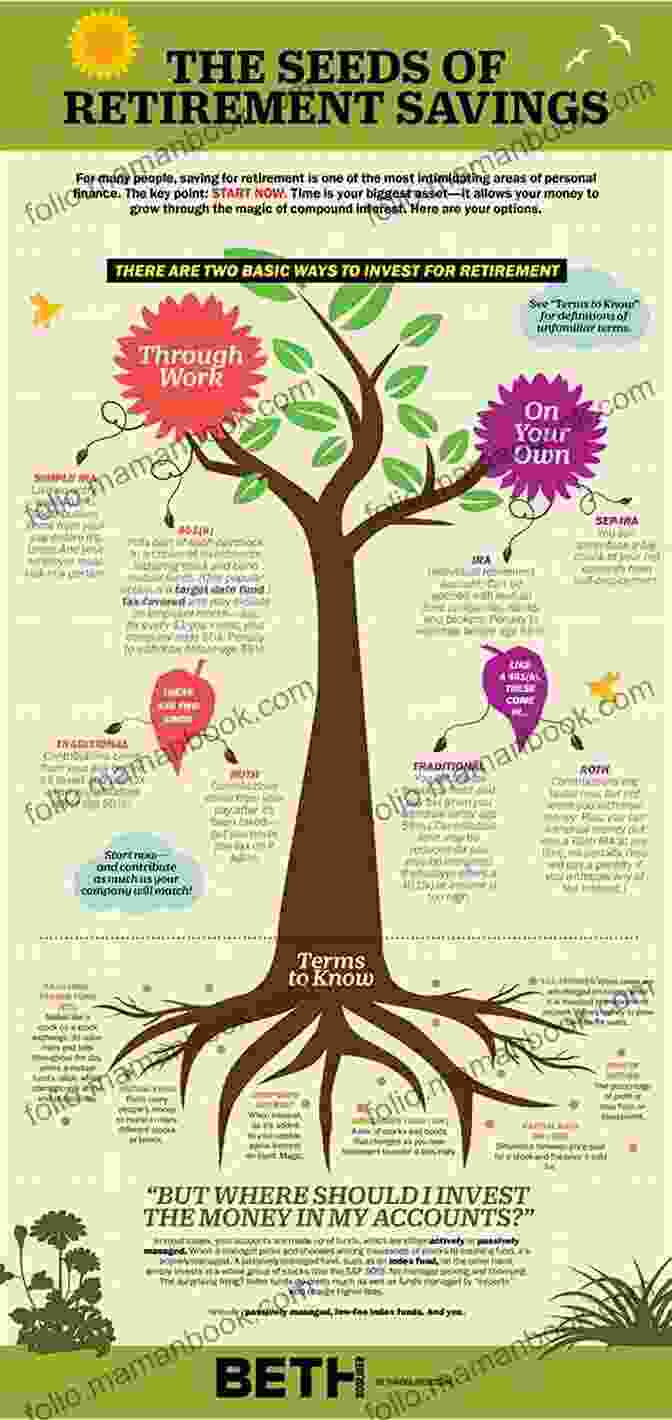

Step 3: Explore Retirement Income Sources

Identify potential sources of retirement income to meet your anticipated expenses. These may include:

* Social Security: Social Security benefits provide a basic level of retirement income for eligible individuals. * Pensions: If you have been employed with a pension plan, you may receive regular payments during retirement. * Retirement savings: Contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can provide significant income in retirement. * Investments: Dividends, interest, and capital gains from investments can supplement other retirement income sources. * Part-time work or business: Some individuals choose to generate additional income through part-time work or business ventures.

Step 4: Determine Retirement Age

The age at which you retire will significantly impact your retirement income plan. Consider factors such as:

* Life expectancy: Assess your life expectancy to estimate the number of years you will need to fund retirement. * Health status: Your health status may influence your ability to work longer or need additional income in the future. * Financial goals: Determine whether you want to retire early or later based on your financial aspirations and lifestyle preferences. * Government regulations: Be aware of government regulations regarding retirement age and benefit eligibility.

Step 5: Calculate Retirement Income Gap

Compare your estimated retirement expenses to your anticipated retirement income sources to calculate any potential income gap. This gap represents the additional income you will need to bridge during retirement.

* Review your budget: If possible, adjust your lifestyle or expenses to minimize the income gap. * Increase retirement savings: Contribute more to your retirement accounts to accumulate a larger nest egg. * Explore additional income streams: Consider part-time work, investing, or starting a business to generate supplemental income. * Delay retirement: Working longer can increase your Social Security benefits and allow for additional retirement savings.

Step 6: Create a Retirement Savings Plan

Based on the identified income gap, develop a savings plan to reach your retirement financial goals.

* Set a savings goal: Determine the amount of money you need to save by your desired retirement date. * Maximize contributions: Contribute as much as possible to your retirement accounts, taking advantage of tax benefits. * Choose appropriate investments: Allocate your savings to a mix of investments that align with your risk tolerance and time horizon. * Rebalance your portfolio: Regularly adjust your investment mix to maintain an appropriate level of risk and return.

Step 7: Seek Professional Advice

Consider consulting with a financial advisor to optimize your retirement income plan. They can provide:

* Personalized guidance: Advisors tailor recommendations based on your individual circumstances and goals. * Investment expertise: Advisors possess knowledge and experience in managing retirement portfolios. * Tax optimization: Advisors can help you minimize taxes through strategic investment and withdrawal strategies. * Emotional support: Advisors provide emotional support and guidance throughout the retirement planning process.

Creating a retirement income plan is essential for ensuring financial security in your golden years. By following the steps outlined in this guide, you can assess your financial situation, estimate retirement expenses, explore income sources, determine your retirement age, calculate the income gap, create a savings plan, and seek professional advice. Remember that retirement planning is an ongoing process, and you should regularly review and adjust your plan as your circumstances change. By taking proactive steps now, you can secure your financial future and enjoy a comfortable and fulfilling retirement.

4.7 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 93 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Jay Posick

Jay Posick Jen Geigle Johnson

Jen Geigle Johnson Kevin Winchester

Kevin Winchester Jane Riley

Jane Riley Viktor E Frankl

Viktor E Frankl Francis Fukuyama

Francis Fukuyama Jalal Al Din Rumi

Jalal Al Din Rumi Louise Allen

Louise Allen Robert D King

Robert D King Juliet Anderson

Juliet Anderson Martin Bachmeier

Martin Bachmeier Barbara Kindermann

Barbara Kindermann Scarlett Mcleod

Scarlett Mcleod Alan Dean Foster

Alan Dean Foster Lorraine Eden

Lorraine Eden Linda M Kurth

Linda M Kurth Marisela Norte

Marisela Norte Helle Katrine Kleven

Helle Katrine Kleven Jaan Kross

Jaan Kross Jean Coppock Staeheli

Jean Coppock Staeheli

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Marcel ProustDancing At Lake Montebello: An Exploration of Love, Loss, and Healing Through...

Marcel ProustDancing At Lake Montebello: An Exploration of Love, Loss, and Healing Through...

Edmund HayesA Comprehensive Guide to [Long Tail SEO Keyword] for High School Students -...

Edmund HayesA Comprehensive Guide to [Long Tail SEO Keyword] for High School Students -... Emmett MitchellFollow ·2.2k

Emmett MitchellFollow ·2.2k Ted SimmonsFollow ·9.7k

Ted SimmonsFollow ·9.7k E.M. ForsterFollow ·2.9k

E.M. ForsterFollow ·2.9k Herman MitchellFollow ·8.9k

Herman MitchellFollow ·8.9k Justin BellFollow ·4.4k

Justin BellFollow ·4.4k Jacques BellFollow ·11.3k

Jacques BellFollow ·11.3k Fyodor DostoevskyFollow ·12.3k

Fyodor DostoevskyFollow ·12.3k Evan HayesFollow ·16.3k

Evan HayesFollow ·16.3k

Dean Cox

Dean CoxHow to Make Decisions Easily & Effortlessly: The...

The Different Types of Decisions There...

Gustavo Cox

Gustavo CoxThe End of World War II and the Birth of Baseball's...

The end of...

Patrick Rothfuss

Patrick RothfussThe Dantes: An 11-Family Saga of Billionaires, Soulmates,...

The Dantes is an epic family saga that follows...

Dylan Mitchell

Dylan MitchellSuper Friends: The Animated Adventures That Defined a...

In the vibrant landscape of American...

Jamal Blair

Jamal BlairCollege For Students With Disabilities: We Do Belong

College can be a...

4.7 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 93 pages |

| Lending | : | Enabled |